The financial industry is evolving rapidly, and fintech app development services are at the forefront of this transformation. Fintech applications have revolutionized banking, payments, investments, and lending by offering faster, more secure, and user-friendly solutions. With increasing reliance on AI-driven automation, businesses are now leveraging Machine Learning as a Service (MLaaS) to optimize financial operations.

AI-powered fintech apps automate fraud detection, risk assessment, and customer interactions, reducing manual effort and improving accuracy. For example, robo-advisors analyze financial trends to provide personalized investment advice, while AI-powered chatbots assist customers with banking queries. These automation-driven innovations enhance efficiency and scalability.

One of the biggest enablers of AI integration in fintech is MLaaS, which allows businesses to use pre-built AI models without requiring advanced machine learning expertise. This makes it easier for fintech companies to implement predictive analytics, credit scoring, and fraud detection into their applications.

This blog will explore:

- What is fintech app development?

- How AI and automation enhance fintech applications.

- The role of Machine Learning as a Service (MLaaS) in financial automation.

- How to build a fintech app and estimate development costs.

- Steps to becoming a fintech developer.

By the end, you’ll understand how AI-powered automation is reshaping the finance industry and how businesses can leverage fintech app development services for growth.

What is Fintech App Development?

Fintech app development refers to the process of creating technology-driven financial solutions that facilitate seamless transactions, automate services, and enhance security. These applications serve banks, startups, financial institutions, and businesses that require digital payment processing, wealth management, lending, and insurance solutions.

Why Fintech Apps Are in High Demand

The financial industry is rapidly shifting toward digital-first solutions that provide:

- Instant transactions – Mobile wallets, contactless payments, and UPI-based apps.

- AI-powered risk assessment – Automated credit scoring and fraud detection.

- Personalized banking & investments – AI-driven robo-advisors and wealth management tools.

- Regulatory compliance & security – Blockchain-based records and biometric authentication.

Fintech app development services help businesses create AI-powered and automation-driven solutions that enhance user experiences and improve financial operations.

In the next section, we’ll explore how AI and automation are transforming fintech applications.

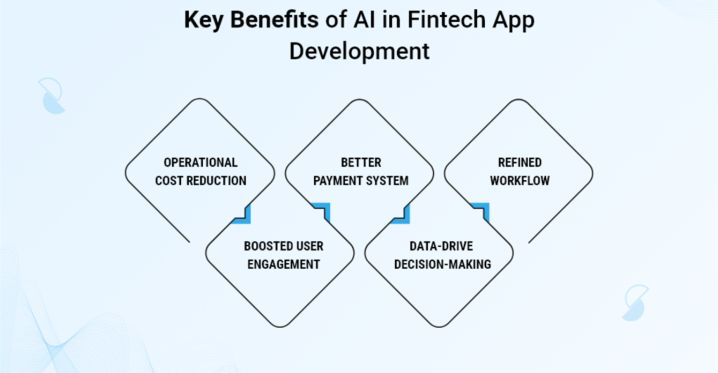

The Role of AI and Automation in Fintech Apps

AI and automation are revolutionizing fintech app development services by enhancing security, improving customer experience, and streamlining financial operations. From fraud detection to automated trading, AI-driven automation is making financial services more efficient and scalable.

How AI is Transforming Fintech

- Fraud Detection & Risk Assessment – AI analyzes transaction patterns in real time to detect suspicious activity and prevent financial fraud.

- Automated Customer Support – AI-powered chatbots handle banking queries, loan applications, and investment guidance.

- Robo-Advisors & AI-Driven Investments – AI analyzes market trends to offer personalized financial planning and portfolio management.

- Smart Loan Processing – AI automates credit scoring and loan approvals by analyzing customer financial history.

- Regulatory Compliance & Security – AI helps financial institutions meet compliance requirements by monitoring transactions and detecting anomalies.

How MLaaS Enhances AI-Powered Fintech Apps

Machine Learning as a Service (MLaaS) allows fintech companies to integrate AI models without in-house AI expertise. MLaaS platforms provide:

- Pre-trained AI models for fraud detection, risk scoring, and automated decision-making.

- Cloud-based AI services that allow fintech apps to scale AI operations securely.

- Seamless API integration, enabling businesses to adopt AI with minimal development effort.

- AI-powered fintech applications are making financial services more accurate, scalable, and customer-friendly.

In the next section, we’ll explore how fintech companies can leverage MLaaS for automation and advanced AI features.

Understanding Machine Learning as a Service (MLaaS) in Fintech

Machine Learning as a Service (MLaaS) is transforming fintech by making AI-powered automation more accessible. Instead of developing AI models from scratch, fintech companies can use cloud-based MLaaS platforms to integrate machine learning into their applications effortlessly.

What is MLaaS?

MLaaS provides pre-trained AI models and machine learning tools via cloud platforms such as:

- Amazon Web Services (AWS) AI – Fraud detection, risk analysis, and personalized recommendations.

- Google Cloud AI – AI-powered credit scoring, financial forecasting, and chatbot services.

- Microsoft Azure AI – Secure identity verification and automated customer service.

How MLaaS Powers Fintech Applications

- Fraud Detection – AI-powered MLaaS services analyze transactions in real-time to detect fraudulent behavior.

- Automated Credit Scoring – Machine learning models assess customer creditworthiness based on financial history.

- Customer Personalization – AI predicts user behavior and provides tailored banking or investment recommendations.

- Regulatory Compliance – MLaaS helps fintech firms stay compliant by monitoring transactions for suspicious activity.

By using MLaaS, fintech businesses can integrate AI without extensive development costs, allowing them to focus on scaling their services.

In the next section, we’ll explore how fintech companies can build AI-powered mobile apps efficiently.

How to Build a Fintech Mobile App?

Developing a fintech mobile app requires careful planning, security measures, and AI integration to enhance automation. Whether you’re building a digital banking app, investment platform, or lending service, each step plays a crucial role in ensuring efficiency and compliance.

Step 1: Define Your App’s Purpose and Compliance Needs

Before development, identify what problem your fintech app will solve. Will it focus on digital payments, AI-driven investing, or automated loan approvals? Financial apps must also comply with GDPR, PCI DSS, KYC, and AML regulations to protect user data and prevent fraud.

Step 2: Choose the Right Tech Stack

A strong backend ensures secure transactions and fast processing. Popular choices include Node.js, Python, and Java for backend development, while Swift (iOS) and Kotlin (Android) work well for mobile applications. AI-driven fintech apps use Machine Learning as a Service (MLaaS) to integrate automation seamlessly.

Step 3: AI-Powered Features and Automation

Integrating AI enhances user experience and security. Fraud detection, AI-powered credit scoring, and robo-advisors are becoming standard in fintech applications. With MLaaS, companies can adopt these features without building AI models from scratch.

Step 4: Security and Data Protection

Security is non-negotiable in fintech. Apps should implement multi-factor authentication (MFA), biometric logins, blockchain for transaction security, and end-to-end encryption. AI-based fraud detection also plays a critical role in safeguarding transactions.

Step 5: Development, Testing, and Deployment

Once built, rigorous testing for security vulnerabilities, performance, and user experience ensures smooth operation. Regular updates keep fintech applications secure and scalable as they grow.

By following these steps, fintech businesses can develop secure, AI-driven financial apps that meet modern demands.

In the next section, we’ll explore how much it costs to develop a fintech app and how businesses can budget effectively.

The Cost of Developing a Fintech App

Fintech app development costs depend on complexity, AI integration, and security. A basic fintech app costs $30,000 – $100,000, while AI-driven solutions can exceed $100,000 – $500,000.

To reduce costs:

- Use Machine Learning as a Service (MLaaS) instead of building AI from scratch.

- Start with a Minimum Viable Product (MVP) and scale gradually.

- Work with experienced fintech developers to optimize resources.

How to Become a Fintech Developer

To build fintech apps, developers need expertise in Python, Java, Kotlin, or Swift. AI-driven fintech development requires MLaaS knowledge, fraud detection integration, and understanding of GDPR & PCI DSS compliance.

Essential skills:

- AI & automation for risk assessment and financial predictions.

- Blockchain & encryption for secure transactions.

- Hands-on experience with robo-advisors or loan automation.

Next, we’ll summarize how fintech and AI automation are reshaping finance

Conclusion

AI and fintech app development services are reshaping finance by enhancing security, automation, and customer experience. With Machine Learning as a Service (MLaaS), businesses can integrate AI without complex development.

Fintech apps streamline payments, lending, investments, and fraud detection, making financial services faster and smarter.

Looking to build an AI-powered fintech app? Partner with Predikly to create secure, scalable financial solutions. Start your fintech transformation today.